The insurance industry has experienced a significant transformation over the past few years, largely due to advancements in digital tools and data analytics. Today, insurance is no longer a world of extensive paperwork and slow claims processing.

With AI-driven risk assessments, real-time data collection, and mobile-friendly solutions, insurance has become more efficient, accurate, and customer-focused than ever. This article delves into the changes digital and analytics bring to insurance, explaining why they matter and how they’re shaping the future of the industry.

The How of Digital and Analytics in Insurance

In today’s fast-paced world, the “how” of digital and analytics in insurance goes beyond theory; it involves practical, real-world applications that are fundamentally changing the insurance landscape.

With digital tools, insurers are now able to provide instant quotes, facilitate faster claims processing, and create custom policies tailored to individual needs. This shift isn’t just beneficial to the companies; it also improves the overall customer experience, making insurance more accessible and personalized.

Why Should You Care?

For many, insurance might seem like an outdated concept, but these changes bring significant benefits for both consumers and providers. Consider these stats:

- 73% of customers now buy insurance online: Consumers increasingly prefer the convenience of digital services, and insurance companies have adapted by offering online platforms for policy purchases.

- Claims processing is five times faster with analytics: By using data-driven insights, insurance companies can speed up the claims process, making it easier for customers to get quick support.

- 40% cost savings for companies using data analytics: For insurers, data analytics reduce operational costs, which can lead to more competitive premiums for policyholders.

These statistics illustrate how digital and analytics are not just trends; they’re reshaping the way insurance functions at every level.

The Real Changes Happening Now

The following are some real changes happening now:

Smart Data Collection

In the modern insurance landscape, every customer interaction, claim, and piece of information contributes to a wealth of data. Insurance companies can now leverage this data in meaningful ways. Here’s a look at some data sources they utilize:

- Driving Patterns: Apps track drivers’ habits, such as speed and braking behavior, allowing insurers to assess risk more accurately.

- Home Sensors: Data from home security and monitoring systems helps insurers understand risk factors associated with property coverage.

- Health Trackers: Wearable devices provide insights into a person’s health, helping companies adjust premiums and create health-based policies.

- Social Media Signals: Insurers use social media analytics to detect potential fraud and assess risk.

Smart data collection enables insurers to create more accurate risk assessments and personalized policies, making insurance less of a one-size-fits-all solution.

Better Risk Assessment

Risk assessment has always been at the core of insurance, but now it’s more data-driven than ever. With AI, insurers can analyze complex patterns that might not be immediately obvious. Key advancements include:

- AI-Powered Insights: AI algorithms can detect patterns and trends that human analysts might miss, offering a more precise view of potential risks.

- Real-Time Pricing Adjustments: Insurance premiums can now adjust based on real-time data, allowing insurers to offer dynamic pricing based on a customer’s actual behavior.

- Customized Policies: Insurers can now create personalized policies tailored to individual needs and behaviors.

- Faster Approvals: For customers with low-risk profiles, insurance approval processes are much faster, ensuring a streamlined experience.

With these advancements, insurers are now equipped to provide more accurate and efficient services, benefiting both the companies and their customers.

Read This Blog: Shining Star Driving School in Wethersfield CT

Claims Processing That Makes Sense

Claims processing has historically been a slow and complicated process, but with digital advancements, it’s now faster and easier. Here’s how claims are managed today:

- Photo Evidence Through Apps: Customers can submit photos of damage directly through mobile apps, making it easier for insurers to assess claims.

- Instant Damage Assessment: AI tools can evaluate the extent of damage in seconds, allowing for quicker decisions.

- Automatic Payments for Simple Claims: Simple, low-risk claims can be processed automatically, enabling instant payments to customers.

- Effective Fraud Detection: Advanced analytics help identify potential fraud, ensuring that legitimate claims are prioritized.

These improvements make claims processing less of a hassle for policyholders, allowing them to receive timely support when they need it most.

What’s Working Right Now (2024)

Here are a few that are currently working:

Mobile-First Everything

Today’s insurance experience has gone mobile. Insurers offer a range of mobile-first services, such as:

- Claims Filing via WhatsApp: Customers can now file claims through messaging platforms, streamlining the process.

- Policy Updates via Text: Simple policy adjustments can be managed through SMS, giving users quick access to their insurance details.

- Voice Commands for Basic Services: Voice-activated assistants can help with routine tasks, making it easier to navigate insurance options.

Personalized Coverage

Customization is a hallmark of modern insurance. With the ability to analyze individual behaviors, insurers offer more tailored coverage options, including:

- Pay-Per-Mile Car Insurance: Premiums are calculated based on the number of miles driven, offering cost savings for infrequent drivers.

- Usage-Based Home Coverage: Insurance policies are adjusted according to how a property is used, providing flexibility for homeowners.

- Health Premiums Linked to Lifestyle: Health data enables insurers to reward healthy behaviors with lower premiums.

Automated Customer Service

Digital insurance tools extend to customer service, providing around-the-clock assistance without the wait times. Today’s automated customer service includes:

- 24/7 Chatbots: AI-powered chatbots handle basic queries, helping customers at any time of day.

- Voice Systems: Voice recognition systems understand diverse accents, making interactions smoother and more accessible.

- Smart Email Routing: Emails are directed to the right department instantly, cutting down response times.

What’s Coming Next?

Looking ahead, several key innovations are expected to further transform the insurance industry:

- Blockchain for Instant Verification: Blockchain technology promises secure, instant claims verification, reducing processing time and enhancing transparency.

- IoT Devices for Home Insurance: IoT (Internet of Things) devices, such as smart home systems, can help reduce risks and premiums.

- Voice Analytics for Fraud Detection: Advanced voice recognition may help detect fraudulent claims, improving security.

Read This Blog: Nearly South Eureka Parkzhou Nikkeiasia: A Hidden Gem

Frequently Asked Questions

Is my data safe with digital insurance?

Insurance companies use bank-level security, including encryption and strict privacy policies, to protect your data.

Can I still talk to real people?

Yes, digital tools offer convenience, but human support remains available for more complex issues or personalized assistance.

Will this actually save me money?

Many customers save 15-30% on premiums by opting for digital insurance, thanks to more efficient processes and risk-based pricing.

What if the system makes a mistake?

Human oversight is always part of the process, and you can appeal or review any automated decisions.

How do I get started with digital insurance?

Start by downloading your insurer’s app, exploring their website, or trying a simple digital feature like filing a claim online.

Conclusion

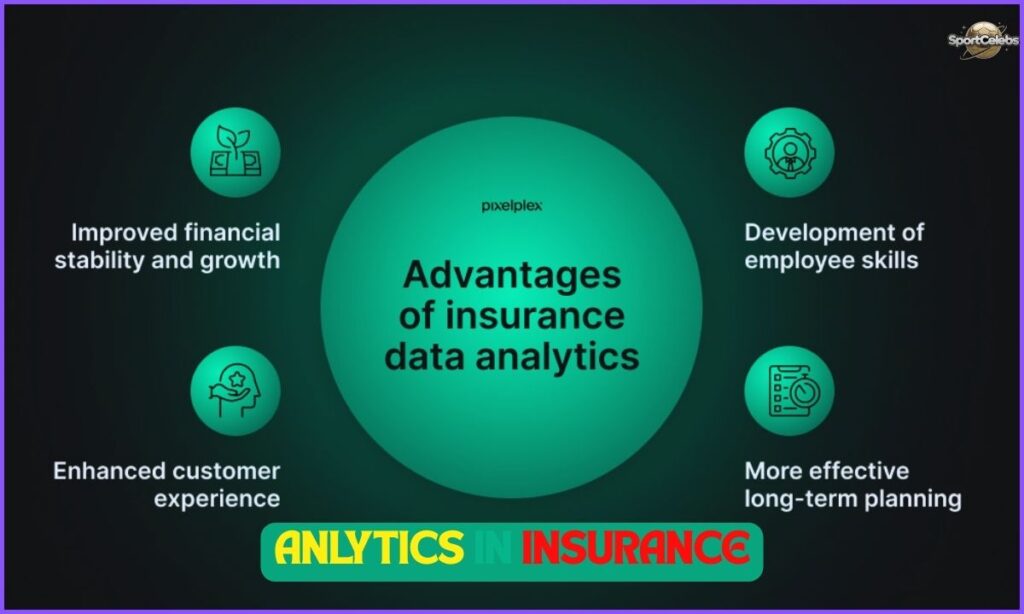

The future of insurance is undoubtedly digital, with data and technology transforming how we buy, manage, and use insurance. As insurers embrace digital tools, customers benefit from faster, more personalized services.

Data analytics enables better risk assessment and pricing, while mobile-first solutions make the insurance experience more accessible. From instant claims processing to customized policies, digital insurance is reshaping the industry to be more customer-centric and efficient.

In a world where convenience and customization are key, understanding the role of digital and analytics in insurance helps you make informed choices about coverage. Whether you’re looking to save money or streamline the claims process, digital insurance options are here to simplify and enhance the way you manage your policies.

Ansa is a talented content writer and digital marketer with expertise in SEO, social media management, and online marketing. She excels at creating impactful, data-driven content to help businesses connect with their target audience and achieve measurable outcomes.